Just ahead of gathering information on the activities of NBFC software features, a very basic question that comes up is, what is NBFC software? Gtech’s crafted NBFC Software is customizable, and compact and is considered a mode of solution that serves an NBFC organization. Our specialized NBFC Software focuses on reducing the operational cost of an organization. This best, advanced NBFC software features are very important that is required to operate a NBFC company in Delhi, Kolkata, West Bengal, Kerala, Maharashtra, Karnataka, Assam, Uttar Pradesh, Madhya Pradesh, Rajasthan, Chennai, Tamil Nadu, Hyderabad, Telangana, Gujarat, Uttarakhand, Chhattisgarh, Chandigarh, Punjab, Andhr Pradesh. Moreover, it is completely web-based software that allows easy access to the data and information regarding the financial transactions of an NBFC organization.

Our NBFC loan management software features is based on all types of Non-Banking Financial business management. Regardless of the type or the size of your business, our NBFC application software features fits the best to smooth the working of Financial and business processes. It also computerizes your credit board cycle. This is quite enough to prove that Gtech-provided NBFC Application Software features is much more advanced than its other counterparts. You can effectively manage your NBFC loans and send EMI and outstanding related updates to your clients by sending E-mail and text messages. All these operations can be done automatically and intelligently by our application. You don’t have to waste your valuable time thinking about it. Meanwhile, you can utilize your efforts to develop your NBFC business. Here are some vital questions that come up while the topic of discussion is on activities of NBFC application software,

A. How does NBFC software work?

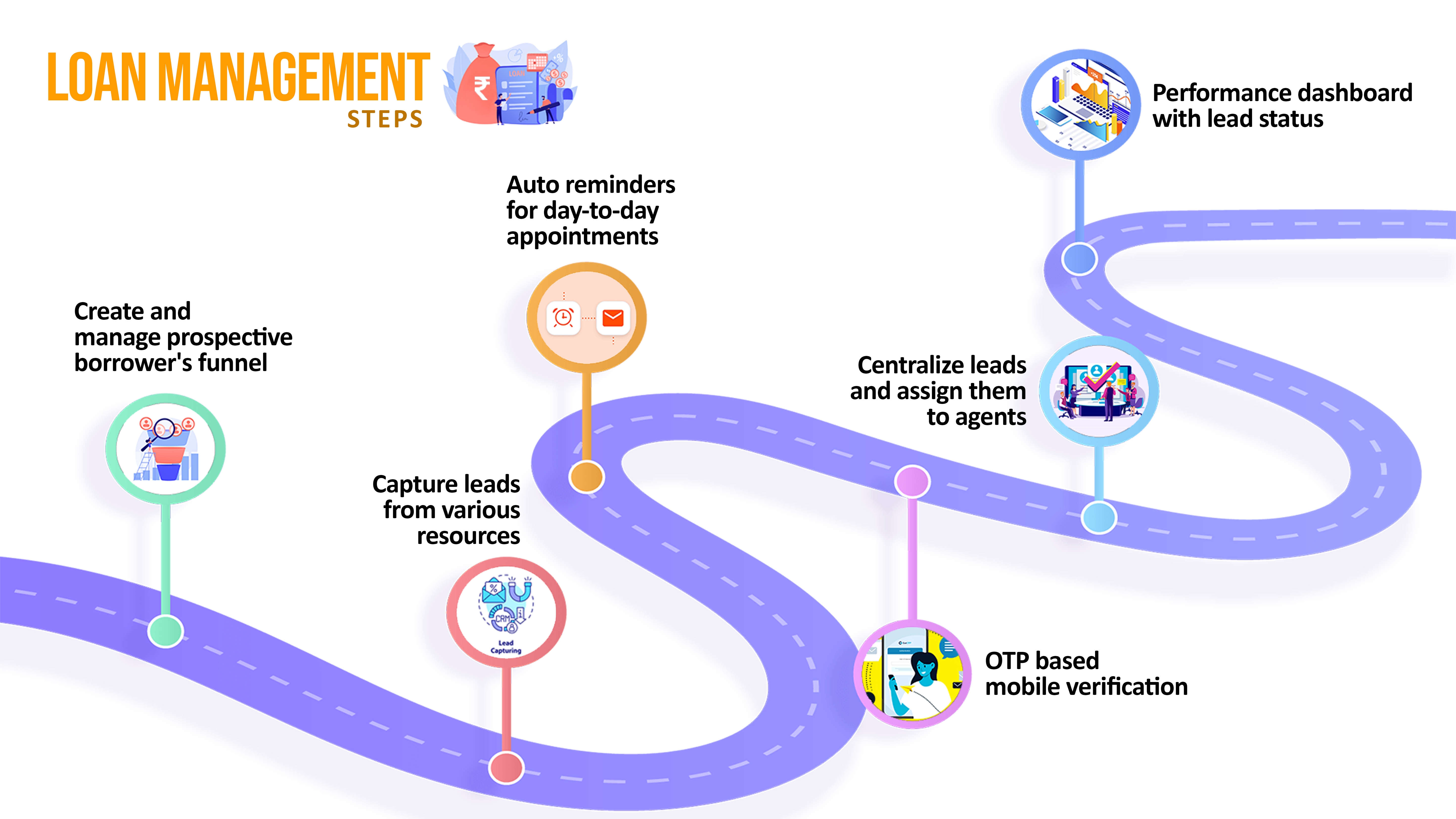

NBFC organizations or Non-Banking Financial Institutions' works are related to monetary transactions and hence to keep up with the data there is a need for NBFC software. NBFC loan

management system is built with a motive to enhance the performance of an organization. In fact, it plays a crucial role in reducing the chances of errors in a financial organization. It also aids in the working efficiency

of a company. The web-based online NBFC Software features in Delhi, Kolkata, West Bengal, Kerala, Maharashtra, Karnataka, Assam, Uttar Pradesh, Madhya Pradesh, Rajasthan, Chennai, Tamil Nadu, Hyderabad, Telangana, Gujarat,

Uttarakhand, Andhr Pradesh, Chhattisgarh, Chandigarh, Punjab is effective at accepting payments online, and it allows you to expand your NBFC business internationally.

B. Where is NBFC software used?

As the name suggests NBFC software is used in financial organizations to handle and monitor the transactions and records of a company. It is a tiresome and risky task to operate

by manpower and thus by using NBFC software every other company in the NBFC sector can be capable of performing optimum peer-to-peer lending tasks.

The sequence of actions and steps involved in designing, building, testing, delivering, and sustaining software applications is referred to as software workflow. It is the procedure that software development teams use to produce and deliver software products.

A software workflow typically consists of several steps, including requirements gathering, design, coding, testing, debugging, deployment, and maintenance. Each stage may include a variety of jobs and sub-tasks carried out by various

team members.

Efficient software workflows assist development teams in streamlining procedures, improving cooperation and communication, and ensuring that software is delivered on time and on budget. Development teams can also verify that their

software meets the appropriate quality and functionality criteria by developing a defined procedure.

A debt collection/recovery CRM (Customer Relationship Management) system is a necessary tool for firms who need to handle their debt collection and recovery activities properly. This software solution assists businesses in centralising all client information, payment history, and communication logs. A debt collection/recovery CRM may save organisations substantial time and money by automating many of the manual operations involved with debt collection, such as issuing reminders, monitoring payments, and managing overdue accounts. Furthermore, this technology may assist firms in improving their cash flow, reducing bad debt write-offs, and maintaining stronger client connections. A debt collection/recovery CRM is a fantastic investment for firms wishing to streamline their debt collection and recovery operations.

Software is an essential aspect of every type of business and when the business is related to monetary transactions it becomes vital. These organizations also provide small loans to people who do not have the privilege of accessing banking facilities. As a microfinance organization perform numerous financial actions, therefore it becomes necessary to use microfinance software for the following benefits,

With its advanced features such as automation of manual processes, improved data management, enhanced customer experience, better risk management, increased access to financial services, and better decision-making capabilities, microfinance software has the potential to significantly impact the lives of many people and communities by providing access to essential financial services. By leveraging the benefits of technology, microfinance institutions can help to drive financial inclusion and promote sustainable economic growth.

While getting into the gold loan business, there are numerous aspects that you need to keep a count of and one of those is the software that will be used to manage the tasks of your business. Gold loan software is specialized software used by financial institutions to manage their gold loan operations. It automates various processes related to gold loan lending, such as loan disbursement, repayment, and data management. This software provides a centralized database for storing and retrieving customer and loan information, which helps institutions to access and analyze data more efficiently. With its advanced features, gold loan software can help financial institutions increase their reach and offer better customer services, ultimately contributing to financial inclusion and sustainable economic growth. Gold loan software is a specialized software used by gold loan lenders to manage their operations. It offers several key features and benefits, including:

In conclusion, gold loan software can help gold loan lenders improve their operations and offer better customer service. With its advanced features, it has the potential to drive financial inclusion and promote sustainable economic growth.

In general, do you know what is the cost of software for NBFC companies in India? Gtech’s market liquidity managing software fits into your system very easily. No Special Hardware configuration is not required here. So maintenance of the system is not required. This makes it a cost-effective solution.

Some common quarries that always come up for NBFC software are as follows,

A. Is NBFC software free?

The best products never come for free and if you are looking to get the best NBFC software features in Delhi, West Bengal, Maharashtra, Kerala, Karnataka, Gujarat, Rajasthan, Punjab, Andhra Pradesh, Tamil Nadu, Telangana, Chhattisgarh, Chandigarh for free, it is useless to expect quality and efficiency from it. Gtech NBFC software is neither free nor cheap, but it comes at an affordable and competitive rate.

B. What is the cost of the best NBFC Software in India?

The cost of NBFC software differs from one another depending on the developer. There are other factors like,

(i) Quality of the software

(ii) Features added to it

(iii) Efficiency

(iv) Storage capacity, etc.

C. Where is NBFC software installed?

With every passing day more and more entrepreneurs and businessmen are getting into the financial business through NBFC companies. In such cases, advanced NBFC software from Gtech turns out to be the most crucial equipment. The services it provides allow our clients to benefit from their business and also gain every other information regarding their business from a single application. Moreover, the adaptability of the software allows the completion of numerous business-related actions like E-KYC, Aadhar verification and other vital tasks without any issues. As mentioned above, our best, advanced NBFC software features in Delhi, Kolkata, West Bengal, Kerala, Maharashtra, Karnataka, Assam, Uttar Pradesh, Madhya Pradesh, Andhra Pradesh, Tamil Nadu, Telangana, Rajasthan, Gujarat, Uttarakhand, Himachal Pradesh, Chhattisgarh, Chandigarh, India has every other property that is needed in a free run of a financial organization and also keeps an account of every member and their performance through a single software. Now getting instant notifications regarding an NBFC business is no more an issue as our specially crafted NBFC management solution provides real-time notices of the activity of a company.